In an unexpected announcement on the evening of January 17, 2024, Tongwei Co., Ltd. (600438.SH) revealed that it anticipates a staggering net loss for the year, projecting figures between 70 billion to 75 billion yuan. This is a stark contrast to their robust 135.74 billion yuan net profit reported for 2023, underscoring the volatile nature of the solar energy market. This news has sent ripples through the investment community, raising concerns about the sustainability and profitability of businesses within the renewable energy sector, particularly those heavily reliant on solar technology.

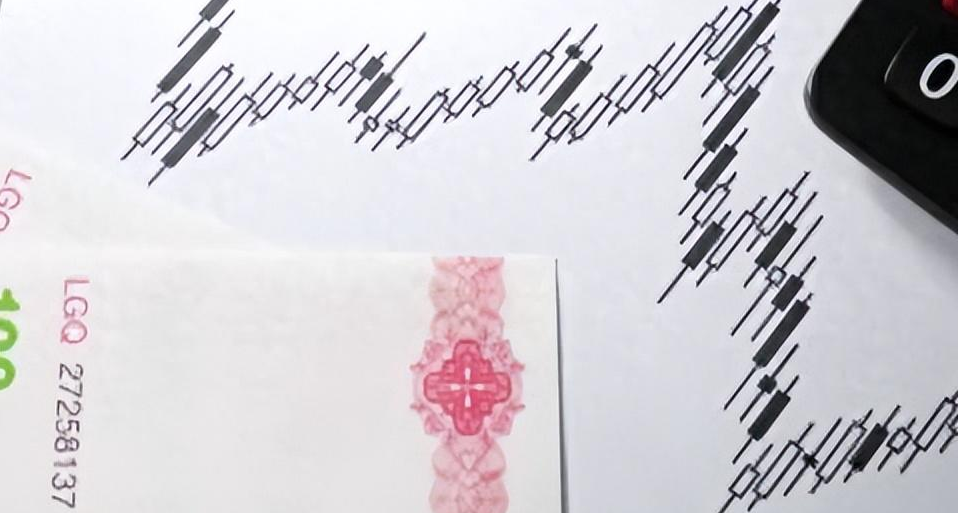

The company’s declaration detailed that while they expect to maintain a positive operational cash flow, external pressures such as significant price reductions across the solar supply chain and long-term asset impairments will critically impact their overall profitability, leading to the forecasted losses. This situation reveals a broader trend in the photovoltaic (PV) sector, where supply chain complications and fluctuating market prices are becoming commonplace, raising questions about market health and future growth.

Tongwei operates primarily in two segments: photovoltaics and agriculture. The photovoltaic branch, which comprises the production and sale of silicon materials, solar cells, and modules, was responsible for over 70% of the company's revenue in the previous fiscal year. The agricultural segment contributes approximately 20%, illustrating a diverse yet significantly solar-focused revenue architecture. Despite the historical performance of Tongwei's solar segment, which boasted a remarkable annual revenue growth rate exceeding 60% from 2021 to 2023, the looming prospects for 2024 appear grim amidst the current market realities.

By mid-2024, the silicon material sector experienced a cash flow deficit, marking a drastic shift from previous profitability. A key figure in the company, Liu Hanyuan, expressed concerns in late November regarding the "over-competition" within the solar industry, which he termed as “internal competition” or "Jiānqū" in Chinese. He elaborated on the fragile balance between healthy competition and destructive practices that can destabilize entire sectors. Liu's analogies, such as the potential consequences of complacency within competitive environments, resonate deeply amidst the ongoing market challenges.

Amidst the turmoil, Tongwei remains hopeful about the overarching growth potential of China's solar industry, citing the country's critical role in global energy transformation. In their bleak earnings forecast, the company reiterated its long-term strategic goals, affirming a commitment to becoming a world-class clean energy operator. Their optimism hinges on the belief that the Chinese photovoltaic sector is poised for continued progression despite the current downturns, fueled by governmental policies and global energy needs.

Liu's perspectives on the cyclical nature of market conditions further emphasize that fluctuations are intrinsic to all industries. He likened the industry's current challenges to the literary theme in "The Sorrows of Young Werther," suggesting a poignant reflection on the emotional and economic dilemmas faced by players in this field. Liu embraced the philosophy that market surpluses and shortages are part of an inevitable cycle, which, while disruptive, eventually leads to equilibrium.

However, significant developments unfolded as a response to these ongoing challenges. On December 24, 2024, Tongwei's official micro blog announced new measures aimed at countering what they termed "violent competition" by progressively adjusting production capacities. This adjustment involves technological renovations and maintenance at four of its high-purity silicon production facilities, affecting over 900,000 tons of polysilicon production capacity. By regulating supply, the company hopes to balance production with fluctuating demand, thereby stabilizing volatile market conditions.

As a result of these production cutbacks, there are early signs that the prices within the solar supply chain are stabilizing. Notably, research from InfoLink Consulting and other industry analysts indicates a slight rebounding in pricing post the company’s announcement about reducing output. The immediate impact of these efforts is noteworthy as silicate producers are responding to challenges by lowering loads, delaying new projects, and reducing operational hours to manage inventory. Currently, polysilicon plants across China are operating at well below their full capacity, reflecting a careful strategy to navigate an essentially moribund market.

Looking ahead, analysts believe that those in the silicon industry, including Tongwei, may begin to see positive shifts by the first half of 2025 as inventory levels normalise. Huashan Securities noted that should prices return to viable levels, Tongwei stands to benefit significantly, potentially recovering lost ground in their overall financial metrics. It’s an all-too-familiar scene where the resilience of a company in the face of adversity will largely determine its fate amidst market enhancements and setbacks.

Overall, Tongwei's experience encapsulates broader themes within the renewable energy sector, serving as a cautionary tale about the complexities of market dynamics, pricing pressures, and the relentless push for innovation and efficiency in response to competitive challenges. Their commitment to a long-term vision, coupled with strategic responses to current adversities, may well navigate the company through this precarious phase and into a future where renewable energy remains a cornerstone of global economic stability and environmentally sustainable growth.